Before the start of the phases 1 and 2 of the EU emissions trading system (EU ETS), each EU country decided on the allocation of their emission...

Set up in 2005, the EU ETS is the world’s first international emissions trading system. It is now in its fourth phase (2021-2030).

On 14 July 2021, the European Commission adopted a series of legislative proposals setting out how it intends to achieve climate neutrality in the EU by 2050, including the intermediate target of an at least 55% net reduction in greenhouse gas emissions by 2030. The package proposes to revise several pieces of EU climate legislation, including the EU ETS, Effort Sharing Regulation, transport and land use legislation, setting out in real terms the ways in which the Commission intends to reach EU climate targets under the European Green Deal.

First steps

The 1997 Kyoto Protocol set for the first time legally-binding emissions reduction targets, or caps, for 37 industrialised countries. This led to the need for policy instruments to meet these targets.

In March 2000, the European Commission presented a green paper with some first ideas on the design of the EU ETS. It served as a basis for numerous stakeholder discussions that further helped shape the system.

The EU ETS Directive was adopted in 2003 and the system was launched in 2005.

The cap on allowances was set at national level through national allocation plans (NAPs).

Phase 1 (2005-2007)

This was a 3-year pilot of ‘learning by doing’ to prepare for phase 2, when the EU ETS would need to function effectively to help the EU meet its Kyoto targets.

Key features of phase 1:

- Covered only CO2 emissions from power generators and energy-intensive industries

- Almost all allowances were given to businesses for free

- The penalty for non-compliance was €40 per tonne

Phase 1 succeeded in establishing

- a price for carbon

- free trade in emission allowances across the EU

- the infrastructure needed to monitor, report and verify emissions from the businesses covered.

In the absence of reliable emissions data, phase 1 caps were set on the basis of estimates. As a result, the total amount of allowances issued exceeded emissions and, with supply significantly exceeding demand, in 2007 the price of allowances fell to zero (phase 1 allowances could not be banked for use in phase 2).

Phase 2 (2008-2012)

Phase 2 coincided with the first commitment period of the Kyoto Protocol, where the countries in the EU ETS had concrete emissions reduction targets to meet.

Key features of phase 2:

- Lower cap on allowances (some 6.5% lower compared to 2005)

- 3 new countries joined – Iceland, Liechtenstein and Norway

- Nitrous oxide emissions from the production of nitric acid included by a number of countries

- The proportion of free allocation fell slightly to around 90%

- Several countries held auctions

- The penalty for non-compliance was increased to €100 per tonne

- Businesses were allowed to buy international credits totalling around 1.4 billion tonnes of CO2-equivalent

- Union registry replaced national registries and the European Union Transaction Log (EUTL) replaced the Community Independent Transaction Log (CITL)

- The aviation sector was brought into the EU ETS on 1 January 2012 (but application for flights to and from non-European countries was suspended for 2012)

Because verified annual emissions data from the pilot phase was now available, the cap on allowances was reduced in phase 2, based on actual emissions. However, the 2008 economic crisis led to emissions reductions that were greater than expected. This led to a large surplus of allowances and credits, which weighed heavily on the carbon price throughout phase 2.

Phase 3 (2013-2020)

The reform of the ETS framework for phase 3 (2013-2020) changed the system considerably compared to phases 1 and 2.

The main changes included:

- a single, EU-wide cap on emissions in place of the previous system of national caps;

- auctioning as the default method for allocating allowances (instead of free allocation);

- harmonised allocation rules applying to the allowances still given away for free;

- more sectors and gases included;

- 300 million allowances set aside in the New Entrants Reserve to fund the deployment of innovative, renewable energy technologies and carbon capture and storage through the NER 300 programme.

Evolution of the European carbon market

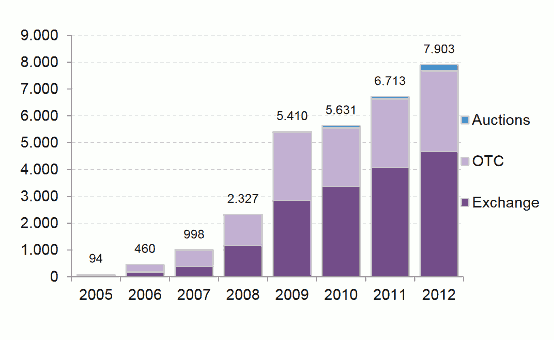

The market in emission allowances developed strongly from the start.

In phase 1, trading volumes rose from 321 million allowances in 2005 to 1.1 billion in 2006 and 2.1 billion in 2007, according to the World Bank’s annual Carbon Market Reports.

The EU ETS remained the main driver of the international carbon market during phase 2. In 2010, for example, EU allowances accounted for 84% of the value of the total global carbon market. Trading volumes jumped from 3.1 billion in 2008 to 6.3 billion in 2009. In 2012, 7.9 billion allowances were traded (worth €56 billion).

Daily trading volumes exceeded 70 million in mid-2011, data compiled by Bloomberg New Energy Finance and London Energy Brokers Association show.

Trading volumes in EU emission allowances (in millions)

Source: Bloomberg New Energy Finance. Figures taken from Bloomberg, ICE, Bluenext, EEX, GreenX, Climex, CCX, Greenmarket, Nordpool. Other sources include UNFCCC and Bloomberg New Energy Finance estimations.

- 18/08/2011 - Commission Decision on amending Decision 2007/589/EC as regards the inclusion of monitoring and reporting guidelines for greenhouse gas emissions from new activities and gases

- 08/06/2010 - Commission Decision 2010/345 amending Decision 2007/589/EC as regards the inclusion of monitoring and reporting guidelines for greenhouse gas emissions from the capture, transport and geological storage of carbon dioxide

- 16/04/2009 - Commission Decision 2009/339/EC of 16 April 2009 amending Decision 2007/589/EC as regards the inclusion of monitoring and reporting guidelines for emissions and tonne-kilometre data from aviation activities

- 17/12/2008 - Commission Decision 2009/73/EC of 17 December 2008 amending Decision 2007/589/EC as regards the inclusion of monitoring and reporting guidelines for emissions of nitrous oxide

- 18/07/2007 - Commission Decision 2007/589/EC establishing guidelines for the monitoring and reporting of greenhouse gas emissions pursuant to Directive 2003/87/EC of the European Parliament and of the Council (MRG 2007)

- 29/01/2004 - Commission Decision 2004/156/EC establishing guidelines for the monitoring and reporting of greenhouse gas emissions pursuant to Directive 2003/87/EC of the European Parliament and of the Council (original monitoring and reporting guidelines)

Technical schemas

- 1a - Overview of technical schema's

- 1b - Change Specification No.1

- 2a - XSD-schema for EUETSRequest

- 2b - XSD-schema for EUETSReport

- 3a - XML-schema for EUETSRequest

- 3b - XML-schema for EUETSReport

- 4 - Code lists document

- 5 - Optionality Specification

Visual representations

- 1a - Tree view representations of EUETSRequest: in pdf and png

- 1b - Tree view representation of EUETSReport: in pdf and png

- 2a - Entity-Relationship Diagrams (ERD's) EUETSRequest: in pdf and vsd

- 2b - Entity-Relationship Diagrams (ERD's) EUETSReport: in pdf and vsd

- 3 - Data elements structure and semantical descriptions